Obtain a loan that's

Type of Loans

How to get Loan on

Rupie Finance

We consider your requirements to be responsibility, so we’ve put up these simple steps for you to follow so you can have a happy future with ease.

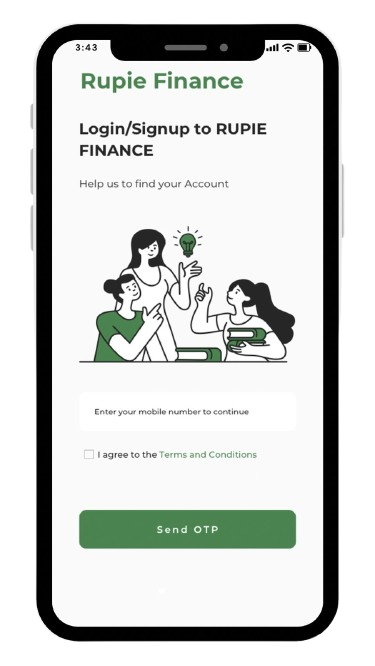

- 1

Sign up using your mobile number.

- 2

Enter your basic information & check eligibility.

- 3

Verify your profile by uploading KYC documents.

- 4

Choose your loan amount and tenure.

- 5

Sign the agreement by OTP

- 6

Get the loan disbursed directly into your bank account.

Why Choose Rupie Finance?

Rupie Finance is a digital app that provides simple, affordable, and accessible financial products and services.

100% Paperless Process

Low Interest Rates

Simple & Secure Process

Fast Processing & Disbursal

Our Impact

Frequently Asked Questions

Rupie Finance is a trusted lending platform that provides two-wheeler loans and MSME business loans through RBI-registered NBFC partners. We ensure a 100% digital process, quick approvals, and transparent terms.

You can apply for a loan if you meet these conditions: Age: 21 - 60 years, Employment: Salaried or Self-employed, Credit History: Minimum CIBIL score of 700, Income: Minimum monthly income of ₹10,000.

Two-Wheeler Loans: Finance for new or used bikes/scooters. MSME Business Loans: For small businesses to manage working capital, stock purchase, or expansion.

Two-Wheeler Loans: Up to ₹1.5 lakh. MSME Loans: Up to ₹5 lakh. The loan amount depends on your eligibility and credit profile.

Sign Up: Enter your mobile number and verify OTP. Fill Basic Details: Personal, employment and income details. Upload Documents: Aadhaar, PAN, income proof. Get Approval & Disbursal: Loan gets approved and credited within 24-48 hours*

Identity Proof: Aadhaar Card, PAN Card. Income Proof: Salary slips / Bank statement / GST details. Vehicle Documents: RC & insurance (for two-wheeler loans).

On average, 24-48 hours after successful verification.

Yes, a processing fee and applicable GST will be charged. The details will be shown before you proceed with the loan.

Interest rates start from 1.25% per month for MSME loans and two-wheeler loans. The final rate depends on your credit profile.

No, Rupie Finance acts as a Loan Service Provider (LSP) for RBI-registered NBFC partners.

You can reach us via: Email: support@rupiefinance.com WhatsApp/Call: +91-8691030707.